Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

ABSTRACT

This project addresses the definition of the connection between the two main factors of macroeconomics, both in the short and long term. Inflation and unemployment are the two factors. The project involves the significance of the two factors, how they are related, and the nature of their connection. Aggregate demand and supply macroeconomic ideas have been used. The connection between inflation and education is recognized and explained using examples, secondary information and statistical instruments. A country’s monetary policy affects inflation and aggregate demand for products and services in the short term. Therefore, the need to generate these products and services for human resources also differs. Countries have issues controlling unemployment if monetary policy is used to reduce inflation. Economist A described this situation well. W. Phillips showed in 1958 that unemployment is small with elevated inflation and vice versa. Today this connection is known as the curve of Phillips. When inflation occurs in an economy, monetary policy is used to decrease it, either by currency supply contraction or interest rate increases. Higher interest rates lower consumption and investment, leading to reduced aggregate demand, while the general supply stays the same. Inflation would drop with the decline in aggregate demand. If real GDP drops, however, businesses will hire fewer employees, leading to a rise in unemployment.

Inflation

According to the neo-classical economists, the economy is always in full employment and inflation being the increase in price level of commodities would occur due to the increase in the money supply within the economy.

On the other hand, Keynes rejected and proposed that the extra money supply boosted aggregate demand, leading to enhanced manufacturing and jobs. Inflation is the rise in economic and manufacturing prices, which remains continuous even after full employment owing to an rise in the money supply.

Therefore, he defined it by saying that ‘inflation is the result if excess aggregate demand over aggregate supply and the true inflation starts after full employment.’

There are different inflation types with its unique causes. For example:

Unemployment

Involuntary unemployment is a term used to define a situation when people who are able and willing to work at the prevailing wage rate are not able to find jobs.

Unemployment rate = ((Number of Unemployed)/ (Labour Force) x 100).

Unemployment can be classified into two types:

Relationship

On the one side, there seems to be an inverse connection between unemployment and inflation. The connection, on the other side, seems much more complex.

The economist A.W. best described this connection. Phillips, using the curve of Phillips. He analysed nearly a century of information (1861-1957) to explore the co-relationship between the pace of wage change and unemployment.

He found that the relationship could be clarified with the assistance of:-

1. The dimension of unemployment –

• When demand for job is high, a few unemployed specialists are prompted to make bosses give greater salaries rapidly, thus prompting a rapid increase in salaries.

• Work demand when low leads to abnormal unemployment, which means employees are unwilling to job at a pay level. In this manner, salary levels are gradually falling in all ways.

2. The rate of change of unemployment –

• If company is blasting, companies are willing to pay greater vivaciously for job, thereby increasing interest for job at a rapid rate. This allows a rapid decrease in unemployment.

Wages and pay rates are the key point price for the undertakings, increasing wage measurement causes the price of the goods to increase equally. This wonder pushes up the rate of swelling.

This is the manner by which Phillips arrived at the resolution and graphically spoke to the connection among unemployment and value expansion and not wage swelling. This graphical portrayal is known as the Phillips Curve.

Business analysts Edmund Phelps and Milton Friedman tested their hypothetical institution at the time when Phillips Curve became well known. They argued that both companies and experts are highly trained and would simply focus on real salaries.

Long Run Phillips Curve

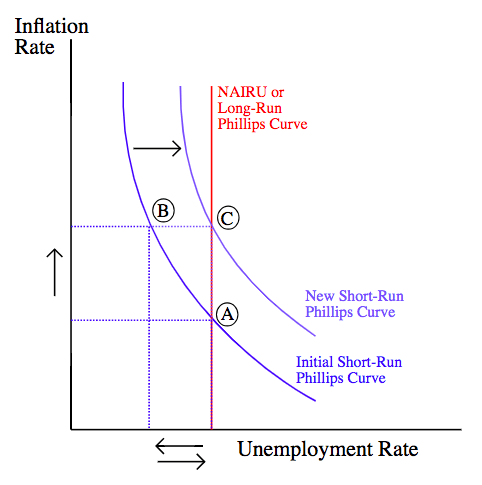

In the brief run, the Phillips curve is really precise, but in the long run, the same is dubious.

In the long run, many economists claim inflation and unemployment are unrelated and there is no trade-off between the two.

The NAIRU (non-accelerating inflation rate of unemployment) theory states that due to the expansionary economic policies there will only be a short term decrease in the levels of unemployment in the economy, until the unemployment shifts back to its natural rate.

Conclusion

In the brief term, as anticipated inflation increases, the Phillips curve rises and monetary policy does not impact unemployment as it returns to its natural long-term unemployment.

Furthermore, the long-term monetary policy contradicts, as it does not permit short-term fluctuations. The monetary authority’s capacity is to decrease unemployment by indefinitely raising the price for a restricted period of time.

Businesstopia. (2018, January 12). Retrieved December 6, 2018, from http://www.businesstopia.net: https://www.businesstopia.net/economics/macro/inflation-meaning-types

Adebowale, K. B. (2015, August ). The Relationship between Inflation and Unemployment. Eastern Mediterranean University . Gazimağusa, Republic of Cyprus: Eastern Mediterranean University.

Hoover, K. D. (n.d.). The Library of Economics and Liberty . Retrieved from http://www.econlib.org: https://www.econlib.org/library/Enc/PhillipsCurve.html

McMahon, T. (2018). InflationData.com. Retrieved from InflationData.com: https://inflationdata.com/articles/inflation-cpi-consumer-price-index-1960-1969/

Graphs and Tables

Table 1. Unemployment and Inflation rates in the Indian economy (1960-69)

| YEAR | UNEMPLOYMENT (%) | INFLATION (%) |

| 1960 | 6.6 | 1.36 |

| 1961 | 6 | 0.67 |

| 1962 | 5.5 | 1.33 |

| 1963 | 5.5 | 1.64 |

| 1964 | 5 | 0.97 |

| 1965 | 4 | 1.92 |

| 1966 | 3.8 | 3.46 |

| 1967 | 3.8 | 3.04 |

| 1968 | 3.4 | 4.72 |

| 1969 | 3.5 | 6.2 |

Graph1. Phillips Curve (1960-69)

Data Source: (McMahon, 2018)

Showing inverse relationship between the variables.

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.